What is a financial portfolio and how to create the best one for you?

Table of Contents

Never consider an ideal financial portfolio containing only your Investments. Generally, people used to say in my financial portfolio have few blue-chip shares, few mutual funds, and few ETFs or they may make some investment in gold too. You never think in this way about your financial portfolio, if look in this way you will miss the bigger picture and that is a blunder.

You should look at your financial portfolio as a whole, as you monitor your financial health, whenever you need to adjust your financial portfolio, you need to focus on your overall financial health and condition at that time. Because the adjustment of an Ideal financial portfolio mainly depends on your risk-taking capacity and your goals.

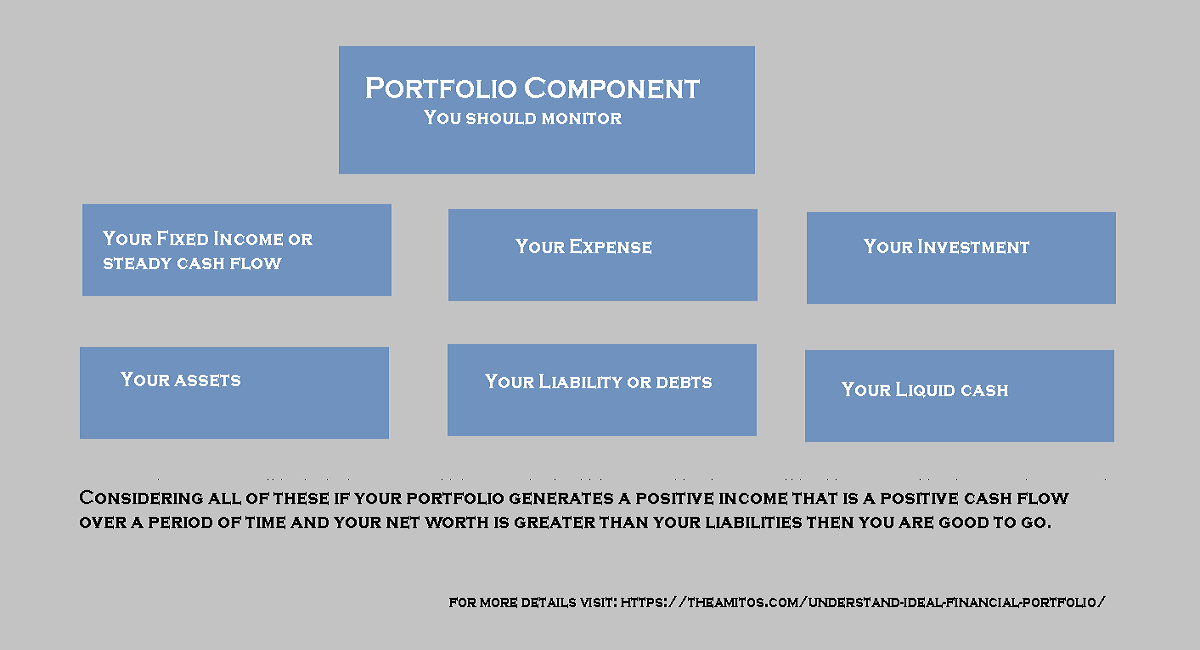

You should consider your portfolio contains these components:

- Your Fixed Income is a steady cash flow

- Your Expense

- Your Investment

- Your assets

- Your Liability or debts

- Your Liquid cash

Considering all of these if your portfolio generates a positive income that is a positive cash flow over a period of time and your net worth is greater than your liabilities at that moment then only consider you build a solid Ideal financial portfolio. If your portfolio misses any of the above components or you don’t know the fixed number of any components then you may need to adjust your portfolio accordingly. Hope this will give you a glimpse of how to think about what an ideal financial portfolio is.

You always be careful that your liabilities never be greater than your assets and your portfolio generates a positive cash flow. You always need to maintain these, if you found yourself that your liabilities are greater than your assets at any point in time then you are in a high-risk zone or you need to figure out your fixed income needs to increase enough to cover this risk. How to figure it out is a complex matter we will talk about it another day.

What is an Investment portfolio?

Now we will discuss an example of an investment portfolio. From the above discussion and also if apply the formula to yourself to test it, then you have a fair idea of what type an investor you are in respect of risk tolerance. In short, an investment portfolio contains the funds or financial assets that you chose to invest in. As per investor risk tolerance and investment time horizons, and your current income, the investment portfolio can be classified into three different categories an aggressive, moderate, and conservative portfolio.

At this point, I want to remind you of one thing before evaluating your overall Ideal financial portfolio if you jump into and concentrate on the investment portfolio you will miss the main purpose of creating the investment portfolio and you will miss the investment goal due to not deciding your goal properly.

I already explain the risk associated with each type of mutual fund in the post Type of mutual fund and their feature section. Now you have to do some research and choose a suitable fund for you. Next, we going to do a comparative discussion of each type of portfolio for your better understanding of the field of Mutual Funds. Remember I have taken mutual funds as an example to show you how to dig into your investment portfolio, you should focus on the process, not on mutual fund investment.

Aggressive Investor Investment Portfolio

An aggressive portfolio is suitable for an investor who has a higher risk tolerance and a higher invested time horizon. The investor should invest for at least seven to ten years before his invested sum is returned and also be willing to accept periods of extreme market volatility thus ups and down in invested money. Aggressive portfolio investor allows this volatility for the possibility of receiving a higher relative return that beat inflation by a wide margin.

The reason behind aggressive portfolio investors need to invest for the long term is to have high fund allocation in stock and riskier investments. If there is a severe downturn in the market then you will need plenty of time to make up for the decline in value. Simply more allocation in stock, the longer the period to invest is appropriate.

Here is an example of a portfolio allocation by mutual fund type for an aggressive investor.

35% Large-cap fund

25% mid-cap Fund

25 % Small cap Fund

15% Bond Fund

Aggressive portfolios are most appropriate for investors at the age of Twenty or Thirty because they typically have decades to invest and recover any losses they may experience, and the return is also quite high.

Moderate Investor Investment Portfolio

A Moderate portfolio is suitable for an investor who has a medium risk tolerance and investing time horizon. The investor should invest for at least more than five years before his invested sum is returned.

Here is an example of a portfolio allocation by mutual fund type for a conservative investor

40% Large-cap fund

30% Hybrid Fund

10 % Small cap Fund

25% Bond Fund

Most investors tend to fall into the moderate category, which means they want to achieve good returns but are not comfortable taking high levels of market risk.

Its best yearly gain might be 20-30%, and its biggest decline in a year may range from 20-25%.

Conservative Investors Investment Portfolio

A conservative portfolio is suitable for an investor who has a low-risk tolerance and invested time horizon from immediate to more than three years. Conservative investors are not willing to accept periods of extreme market volatility and seek returns that slightly beat inflation. Here is an example of a portfolio allocation by mutual fund type for a conservative investor.

15% large-cap fund (Index)

10% Hybrid Fund

5 % Small cap Fund

45% Bond Fund

35% Cash/Money Market

The highest gain this portfolio might have in a calendar year might be 15%, and the worst decline might range from 5 to 8%.

Keep in mind that all investors are different. Even if you fall into one of these three broad categories, your financial situation may differ from that of others. One final piece of advice, before investing in any mutual funds please check the fund’s portfolio and asset allocation( you can check it from the Moneycontrol website).

If you choose two funds of almost the same portfolio your investment risks increase as well as your profit also increases when both funds perform well but you will be in a double loss at the time when funds do not perform well.

Principles of portfolio management

You can not define financial portfolio in a few words. You need to read and understand the all information that I provided above before selecting the best fund for your investment portfolio. The overall motive to create an investment portfolio or you could say the first priority of successful portfolio management is to ensure your investment safety, Your invested money is in the best assets class to achieve the best return at the same time with minimum risk, keep track of your goal for which you have invested, to help choose the best investment option as per one’s age, income, time horizon and risk-taking capacity. In a nutshell, the steps are:

- Plan your investment as per your goal, risk appetite, and investment horizon (I have already discussed in detail here plan your investment.)

- Asset allocation: Choose the right financial asset or instrument type ( Now you know about the various type of mutual funds available in the market, their features, and risk profile. You also have information about the best suitable investment horizon for this type of fund. According to your requirement choose the best one for you.)

- Diversification: create the best investment portfolio that meets your financial goal ( now I am quite confident that you can create your own investment portfolio that meets your financial goal. Details information is provided in the financial portfolio section in this link.)

- Rebalancing, Tax efficiency: For more details information and discussion on asset allocation, rebalancing, and tax efficiency please take a look at the investment planning section.

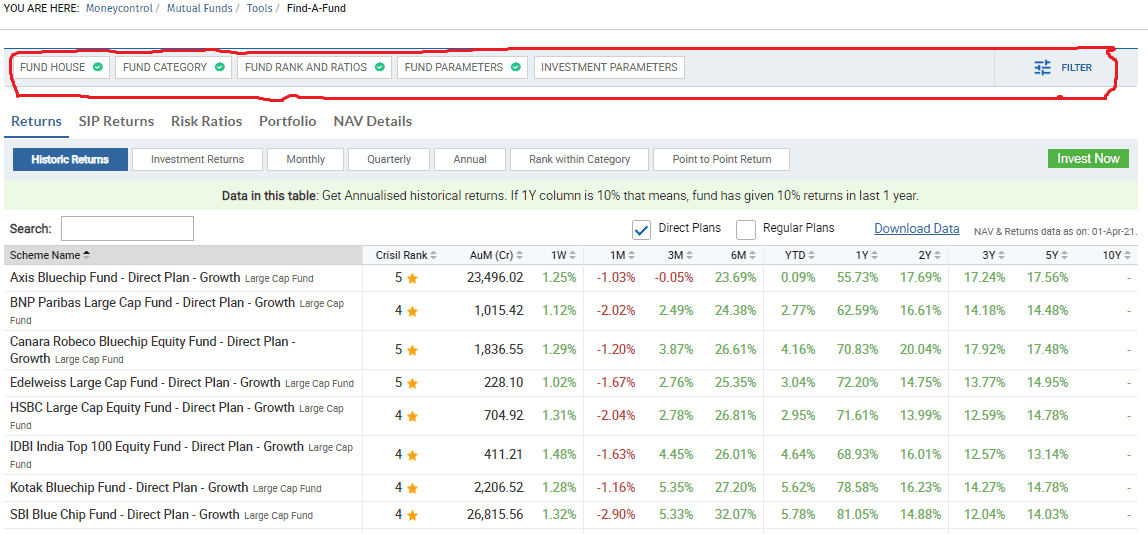

After deciding all the parameters, you can go to the Moneycontol website to get the details about the funds that are available. For your reference, I am attaching the screenshot. In the filter area, you can change the filter criteria as per your requirement like fund house, fund category, fund rank, etc. Hope this may help you.

How to create investment portfolio

To create any portfolio for investment, the first thing you need to know is the goal of your investment. Without a clear goal, there is no meaning to create any investment portfolio. Because if you do not have any financial goal then how do you judge the performance of your portfolio, how do you know your portfolio performance is enough to achieve your goal in a particular time frame, there is no meaning to invest without a specific financial goal.

Other important factors are your current age, your present financial condition, and your risk-taking capacity also matters when creating a financial portfolio. To create a good investment portfolio you need to have knowledge of the various assets where you have to invest so that your portfolio can easily achieve the target of your investment. You have to know the risk profile of various assets and how to allocate funds to those assets without taking too much exposure to risk but also fulfill the targets of your investment.

The name of the game is to achieve your investment targets or your financial goal without taking too much risk. I already discuss almost all of these factors above in this blog post. Hope this will make sense to you. Happy Investing.

0 Comments