Have you ever thought about how a person acquires so much wealth in life? Have you ever thought about how to create a wealthy mindset? In normal cases, we have almost the same life expectancy but with the same amount of time, some of us making so much money that you can not ever imagine, how could they make it possible?

The answer is they are financially literate and make decisions based on the information and knowledge available to them. They train themselves in such a way that they can achieve their financial goal easily through their action, thoughts, and mindset about money. It is quite easy to give advice like start investing your time in yourself, Learn new skills, and secure your future Financially but is it really that much simple?

Sorry, there is no shortcut to this, you need a lot of work and patience to learn this skill but it will pay you a lot you ever thought. Here I am giving you an outline of how to train yourself to get success. Let’s get into the process.

For a better understanding, I have divided the process into three steps Wealth Mindset, Wealth Accumulation, Wealth Acceleration, and Wealth Inspiration but you should keep in mind that the whole thing is a single process.

How to create a wealthy mindset

Table of Contents

It is human nature that we easily overestimate the importance of one defining moment because continuously we are losing one thing which is we are losing every moment. Similarly, it is very easy for us to underestimate the value of making better decisions on a daily basis. Almost every habit that you have, good or bad, is the result of many small decisions over time yet we seem to forget this when we want to make a change.

Our brain only considers any changes meaningful if it is big enough, and the outcome is visible to us. Our normal tendency is always to expect a significant improvement instantly or just after deciding to go for it so that everyone will talks about it whatever may be the goal, it may be losing weight, building a business, traveling the world, or any other goal.

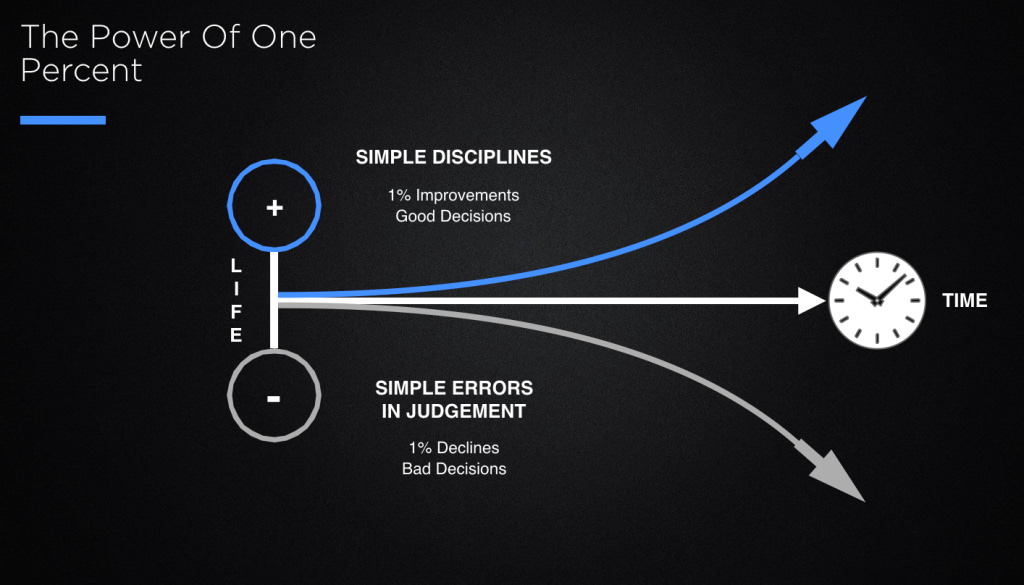

Now, consider improving by just one percent every day is so tiny, not noticeable but can be meaningful in the long run. but it will work the same way in reverse if there is no improvement. If you find yourself stuck with bad habits or poor results or you are overweight, it’s not because something happened overnight. This is the outcome of your many small bad choices, a one percent decline here and there that come up as a problem in front of you today.

In the beginning, it is very hard to differentiate between one percent good choices and one percent worse choices because it has no significant effects on you at that point in time. But as time pass by, these one percent improvements or decline compound over a long period of time and suddenly you find a big difference in the performance of the people who make slightly better decision and people who don’t. This is the main reason small choices don’t affect you at that time but it will sum up over the long run.

The Power of One Percent

Any achievement or failure in life is not a stand-alone event, instead, it is a sum of all small moments when we decide to do things one percent better or one percent worse. and the sum of all these marginal gains makes the difference. You should consider that small wins and slow gains are really powerful. This is why the goal is not greater than the system. Because of this you always need to focus on the process or your habits than achieving certain outcomes.

So where are the one percent improvements in your life? Well, this is where people get bogged down and overwhelmed by all the things they feel like they are meant to be doing and I’m sure most of you feel that way and that’s normal! Everyone has that!

Sometimes, you can get bogged down thinking about all the stuff you need to do so much that you just don’t even bother starting. So I want to share something with you to help with momentum. Because I have used this for many years and I swear by this method.

I want you to think about 10% overall growth per year in all areas Net worth, income, relationships, reading, self-development, health and fitness, diet, and everything. Because 10% per year will make you a long-term master and make a huge difference in your life. There will be people around you that have amazing results instantly but they are the ones that aren’t usually sustainable.

I want you to think about 10% per year.

And you’re probably thinking, hang on, YOU JUST SAID 1%! Well, when you think about 10% per year, that is 1% every 38 days! 1% every 38 days compounded out to 10% per year. All you need to do is become more efficient and effective to the tune of 1% every 38 days! So that you can grasp that, 1% of 1 hour is 36 seconds.

So you have 38 days to come up with a way to be more efficient to the tune of 36 seconds every hour!

Start Investing Your Time to Wealth Accumulation

Focus on How to create wealth

One of the most common reasons people give up on anything is because of results not showing up as fast as they would have liked. Notice I used the phrase “showing up”. The problem is that people think that results do just that.

I have lost count of the number of times I have had to listen to someone talk about how they are going to get in shape and try a new fad diet or exercise regime only to start and give up a week later. Just because they haven’t seen the results immediately, they think there must be something wrong with the system and they wash their hands of it.

With wealth creation, I see people wildly overestimate what is achievable in the first six to twelve months. I can’t say that I blame them. Unfortunately, most companies use hard-sell tactics like selling hopes and dreams because, well, negativity doesn’t quite sell as well.

The reason it doesn’t sell as well is that we humans simply do not want to hear it. We want the fastest route to pleasure avoiding all pain along the way, and because of this, we neglect the compounding effect of the work and effort we put into our journey.

So people massively overestimate what is achievable in the first six to twelve months and so when they are given the truth and realistic expectations, they then massively underestimate what is achievable within twelve to twenty-four months.

An example is weight loss. People go from diet plan to diet plan and from exercise plan to exercise plan. All of these individual plans work, but as they see little results in a short space of time, they try something else before setting realistic expectations on the first plan.

What people fail to realize is that if we work consistently at something we want, there is a compounding effect on our efforts that become progressively noticeable once we start seeing results. This means that once we push through a certain threshold, we see dramatic results. Unfortunately, not many people get to this point due to unrealistic expectations.

Here is an interesting example

for an extreme example to shift your mind into gear, let’s just say you had the skills and ability to generate a 100% return on investment each day but to generate those returns, you had to go out and do a full day’s work every day for seven days per week. Although seven days a week is pretty tough, you would probably jump at the chance to double your money every day right?

Let’s say, we start on the first of the month and you only start with one paisa. You must go out to work that the first day, put in some hard graft to only come home with two paise. Feeling under-rewarded, your alarm clock goes off the next day and you jump out of bed early, make your way to work to slog through another hard day to come home with four paise. You have successfully doubled your money each day but you have put in two days of labor but you have only accumulated four paise, and it’s only day 2.

You keep at it and although you feel tired and undervalued, you do a couple more days and by the weekend, you have sixteen paise.

After week two you are ready to quit. You have had enough of getting out of bed at the crack of dawn, putting in solid days, and then coming home with little reward. Over the 14 days, you have netted a whopping Rs. 81.92. You give up. You feel the reward wasn’t worth it. Too much effort for too little gain, but if you were to keep it up and stick with it, how long do you think it would take you to become a millionaire?

The answer is 28 days. In fact, on day 28, you would have amassed a fortune of Rs. 1,342,177.28. Don’t believe me? Grab a calculator and check for yourself. If it were possible to double your money every day, and you started with one paisa, you would have a total of Rs. 5,368,709.12 after just 30 days.

I haven’t shared this example with you to get you excited about doubling your money every day; I have shared this example to show you the power of compounding growth. This is not just in money, it’s also in skills.

There is a purpose to sharing this example. It takes a while to build momentum but once you reach a certain level, the rest of the journey becomes effortless. It’s important to set your expectations based on your current situation so that you can get excited yet remain grounded without flying off with the fairies and then getting slammed down to earth and giving up. You will know your numbers, your time scales, and the amount of time and effort required to trust the process.

If you want to learn to be successful, you must evaluate your current situation and know exactly how much time and effort it will require. Be patient and take your time, consider many things many things as possible before taking any decision. Remember, I am not about scrimping! But what I AM about is building wealth. So once you work out what you can save money on, instead of clinging to the saved cash, consider transferring that expense to something that will help you to accumulate wealth.

Let’s say for instance you save rupees 200.00 per month. Well, consider spending that rupees 200.00 on self-help books, education, webinars, network events, etc to develop your efficiency in your business, learn a new skill or maybe you spend it on a cleaner to free up more time to build your income. Pay yourself first

Focus on Wealth Acceleration

There is a part of our brain which responsible for our emotional triggers such as fear, greed, affection, anger, etc, etc. This portion of our brain is responsible for keeping us safe from a survival standpoint. This animal instinct part of our brain doesn’t like change and it certainly doesn’t like risk.

When people live hand to mouth and spend more than they earn each month, they are constantly triggering the amygdala because if financial security isn’t stable, there is a chance that basic human needs will be at risk i.e. food, shelter, warmth, etc.

The first stage to accelerating wealth is to keep this part of our brain stable so we can focus on making better decisions that are guided by our soul instead of trying to make quick returns.

The best way to do this is to save a buffer of cash that is kept in your account and should not touch the fund.

I recommend adding up your living expenses (only survival expenses such as food, shelter, etc) and aiming to save enough cash to cover these expenses for at least 3 months. This should be a priority and I would urge you to save as much as possible until you have this safely stashed. Ideally, 6 months’ worth of living expenses would be good but let’s start with 3 months. Once you have 3-6 months of living expenses saved in your cash account, you start to think more freely. You open your mind to opportunities and you see the world in a different way.

You can focus on your business, your job, your relationships, your partnerships, your health, and your social life in a way that allows you to grow which in turn starts to naturally accelerate your income. You feel in control and you become more sensible at making spending decisions.

Another great thing to do is to carry cash. You can set up a separate account for these savings (recommended) and call it your “Survival Brain Account” or you can just have it in cash but you are NOT to spend it!

Concentrate on Yourself to Get Wealth Inspiration

It takes courage to choose independence. You are going to have to sacrifice some of your usual splurges and say no to some nights out or impulse buying. The goal here is to reach a level of freedom that allows you to spend your time in areas you find fulfilling and rewarding. Want financial success? Educate yourself on the Fundamentals. There are no secrets.

Start investing your time to educate yourself financially. Still, there are few colleges and institutions that focus on financial education. Start focusing on the wealth accumulation process and how to change your perception of money if you have any thoughts installed in your inner mind that block you from making more money.

The final thought is to concentrate on yourself to get wealth inspiration and find the beliefs you hold that restrict you from achieving your financial freedom. Look into yourself, Concentrate on your mind, how it processes the money-making concept, and build a money-making mindset, and learn how Money works little by little every day. If today someone is earning more because he has the ability to attract more money toward him. Money has no color, no religion, no choice to whom it will go, the only thing it has the purchasing power.

0 Comments