SIP means Systematic Investment Plans to invest in Mutual funds or any kind of fund. You might think to invest your hard-earned money through the SIP route in the mutual fund. Is SIP a good choice in Mutual Fund for investment? What to do, how to move ahead, and park your funds in the best possible manner through SIP? What should be your plan of action once you decide to invest in SIP? Is SIP good or bad? What are the steps for investing in SIP and how to proceed further? What is the best fund that suits your investment goal?

These are the various queries that might worry you again and again. We are going to discuss all these queries and hope this will clear your doubts so as to help you invest your money in an efficient way.

What Is SIP and How It Works (Systematic Investment Plan)

Table of Contents

SIP i.e. Systematic Investment Plan is a common method followed for wealth creation in the long run. People generally get confused and think that SIP is an investment or product. But, you should know that this is just a method or way of investing. Instead of putting a lump sum amount altogether, you just have to set your own budget and put small amounts every month or any fixed time interval through SIP.

In short, SIP is a method of investment where a fixed amount is invested into mutual funds at regular intervals. SIPs usually reap higher returns if the investment is done for a longer duration.

When you invest money through SIP, your money is invested in Mutual funds. Mutual funds further invest your money in:

- Debt Instruments – Debt Mutual Funds.

- Equity – Equity Mutual Funds.

- Hybrid funds

The returns are based on the performance of these funds over a period of time. Mutual Funds are subject to market risks. So you need to be extra careful while investing in them. But, based on historical data and past performance MFs perform well over a longer period.

Investing your money in Mutual funds, that too by choosing the SIP route is considered the best long-term investment option, for growing your money.

What is sip in mutual funds?

Each Mutual Fund Company/Bank has its own dates for investing. You can choose a date for monthly investment at your convenience. Generally, the dates are 1, 5, 10, 15, 20, and 25 but these can vary based on different companies. You can select multiple dates for investing through SIP in different funds.

Calculate the SIP amount you want to invest every month. Based on your Income and Savings, fix an amount you want to invest in Mutual Funds through SIP. So, if you are ready to start your monthly SIP journey, invest safely and enjoy the returns!

Also, make yourself aware of Taxes on mutual funds to help you in your tax planning. Don’t hesitate to take the help of an experienced Fund Advisor/Financial Advisor if you have any doubts. It’s your money and you have every right to know where and how you are putting it.

Benefits of a Systematic Investment Plan (SIP good or bad)

Before introducing SIP in the mutual fund, very few people know that Mutual Funds as a financial instrument. After introducing SIP in Mutual Funds it became very popular among the investor for long-term investment purposes. Here are details about the benefits of investment through the SIP route. Then you decide if Is SIP good or bad?

Discipline

You attain investment discipline as a fixed amount needs to be invested regularly. This helps in maintaining a focused approach and building a good corpus for yourself. Moreover, parting from a small amount like anything ranging from Rs.500 to Rs.1500 monthly does not seem to be a difficult task. It just inculcates the habit of saving.

E.g. If you are a salaried person getting a monthly salary, it is a very good option to have monthly investments of Rs.500 or Rs.1000 in the form of SIP.

Convenience

All the processes have been made online for the convenience of investors. You just need to set aside small amounts for investment. With the facility of ECS mandate, you can even instruct the bank to allow auto-debit from your savings accounts towards SIP. This will save you from the hassle of signing cheques or making payments yourself. Also, there shall be no chance of missing the monthly or quarterly investment as the case may be.

Rupee Cost Averaging

Investors buy more units when the market is low i.e. NAV (Net Asset Value) is low and buy fewer units when the market tends to rise. This leads to a reduction in the average cost of purchasing financial assets. This can be seen if the investment is done for long periods where the investor gains maximum benefits due to better cost averaging. Hence you reduce the impact of market volatility on your purchased asset.

Power of Compounding

If you invest small amounts today, you can build a good corpus for your retirement. This is possible with the power of compounding.

In simple terms, Compounding refers to when the Interest of the first year is added to the principal amount of the next year, and in the next year, you earn interest on both Principal and +Interest(For Yr 1). This means you earn not only on the amount invested but on the closing balance including interest earned.

So, the earlier you start investing, the less amount you need to invest over a longer period and the maximum returns you can enjoy. The magic of compounding helps you set a big corpus for your after-retirement life. You can make way for sound financial planning by investing at a young age. These small investments done now will grow your money and you can enjoy higher returns in the years to come.

Big Corpus on Maturity

With the help of cost averaging, you tend to yield high returns over a long period of time especially in equity SIP. But, investing in equity is meant for risk-takers since it does not guarantee assured returns. So, debt funds are a good investment option for safe players who don’t like taking much risk.

Hence, SIP is considered best suited for those having long-term financial objectives. At maturity, you will have a huge corpus to meet your needs.

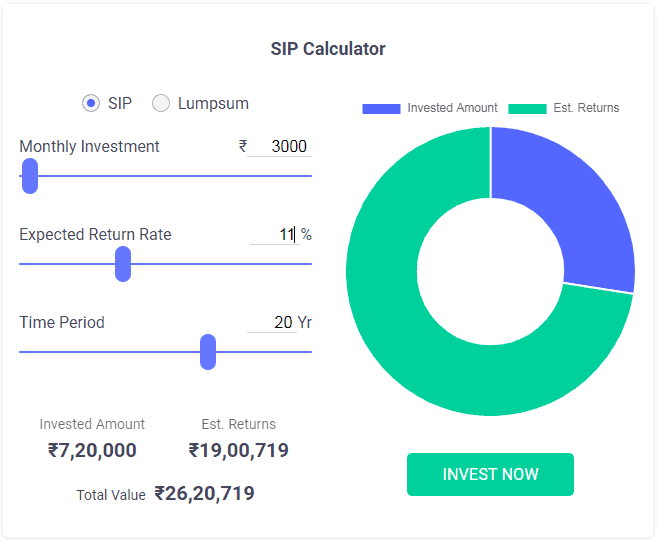

Example: If your child is 2-3 years old and you start your monthly SIP today at an amount of say Rs.3000. You will get a lump sum amount of Rs.25 lakhs approximately after 20 years when your child will pursue higher education. This is just an example based on the average rate of return of 10%-11% over the period. In reality, you are likely to earn a bit lower or higher return over the SIP period.

You can invest through the lump sum mode as well. But, in the present financial scenario, where the markets are highly volatile, SIP is considered the safest mode of investing your money in the long term. Hence, SIP is often referred to as one of the best methods of investing money to plan your Long Term Investments.

SIP can be started by individuals of any age. But, the earlier you start, the better the financial portfolio you can build to reach your goals. Early birds usually win, so be an early bird and plan your financial goals well in advance to reap higher benefits.

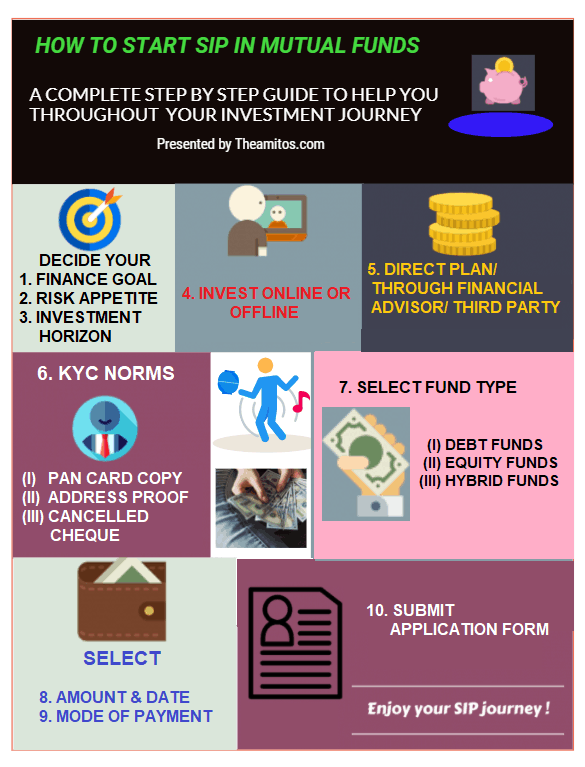

Invest Online/ Offline

You have two alternatives to Invest Offline or Online. To avoid the hassles of going and submitting the forms and documents manually to Mutual Fund companies/Banks, you should prefer the online method of Investing. There are various Online Mutual fund Platforms where you can easily fill out the application forms, upload your documents and requisite proofs and go ahead with the process of investing. So, having an online account will have long-term benefits wherein you can operate your account and invest your funds with much ease.

Invest Directly or Through a Financial Advisor/Third Party

You can opt to invest directly if you have a little bit of knowledge and experience in the field of investing. For example, Mutual Fund Direct plans usually carry less charge. A direct mutual fund is a scheme that investors directly purchase from the fund house or asset management company (AMC). There is no third party, agent, or distributor involved between the investors and fund houses. The amount accumulated at the time of redemption was Rs 34.51 lakhs Rs 32.55 lakhs Rs 1.96 lakhs

| Parameter | Direct Fund | Regular Fund | Difference |

| Monthly SIP amount | Rs 15,000 | Rs 15,000 | 0 |

| Investment Tenure | 10 years | 10 years | 0 |

| Returns | 12% | 11% | 1% |

| The amount accumulated at the time of redemption | Rs 34.51 lakh | Rs 32.55 lakh | Rs 1.96 lakh |

Because of the low expense ratio and higher return over a long period of time, the Mutual fund direct plan provides much more return than the regular plan. No Agent or distributor is involved between the investors and fund houses.

But, if you are new to investing and don’t have any knowledge as to how to start, it is better to take the help of offline financial Advisors. After the registration process is complete, the Mutual fund companies also allocate a Fund Advisor to you, who will guide your way and make your investment journey easier.

Is SIP a good Investment (SIP)

Here are a few things discussed that give you an idea to understand what is sip investment and why SIP is more popular among investors in recent Days.

Low initial investment

You contribute in the form of small amounts weekly, fortnightly, monthly, or quarterly as per your convenience. E.g. you can invest Rs.500 per month also Rs. 2000 on a quarterly basis.

Diversification

You can choose from a variety of financial instruments in mutual funds i.e. debt or equity. These are best suited for long-term wealth creation and fulfilling your long-term goals. The returns are based on how the funds have performed over the SIP period.

Easy to Start

You can open a SIP for say 5 years, 10 years, or 15 years period. The Investment amount is fixed throughout the SIP period. You cannot change the regular SIP amount during its tenure. But you can cancel your SIP registration anytime. Post-dated cheques or Bank ECS Mandate can also be given to Mutual Fund Companies in order to process your requests.

The procedure for investment in mutual funds has become much simpler than it used to be a few years back. You get to explore higher returns while investing small and regular amounts based on market fluctuations. If you want to add anything, any information, or opinions, feel free to share your valuable feedback. Don’t hesitate to share the blog with your family and friends so as to make them aware of this topic.

Hope you found the information useful! You are most welcome to give your valuable feedback in the Comments section below. Do share your experiences on the same, which might help someone else. And yes, if you liked it, don’t forget to share it with your family and friends…

Enjoy Your SIP Journey!

0 Comments